how to take an owner's draw in quickbooks

The information contained in this article is not tax or legal advice and is. Step 5 Enter the total for the withdrawal in the Amount column of the Expenses tab.

Owner S Draw Quickbooks Tutorial

C corp owners typically do not take draws.

. You will pay the owner using an owners draw account. A owners draw is simply a payment from the business to the owneroperator and its not considered taxable incomemeaning the sole proprietor doesnt have to pay any taxes on the money they take out of the business. You have an owner you want to pay in QuickBooks.

If you own a business you should pay yourself through the owners draw account. Select the Bank Account Cash Account or Credit Card you used to make the purchase. Httpintuitme2PyhgjfIn this QuickBooks Payroll tutoria.

An owners draw is an amount of money an owner takes out of a business usually by writing a check. How to Record Owner Draws Into QuickBooks. Also you cannot deduct the owners draw as a business expense unlike salary.

We also show how to record both contributions of capita. From the Detail Type drop-down choose Owners Equity. An owners draw refers to an owner taking funds out of the business for personal use.

To create an Equity account. Enter the contribution amount in the balance field. Owners equity includes all of the money you have invested in the business plus any profits and losses.

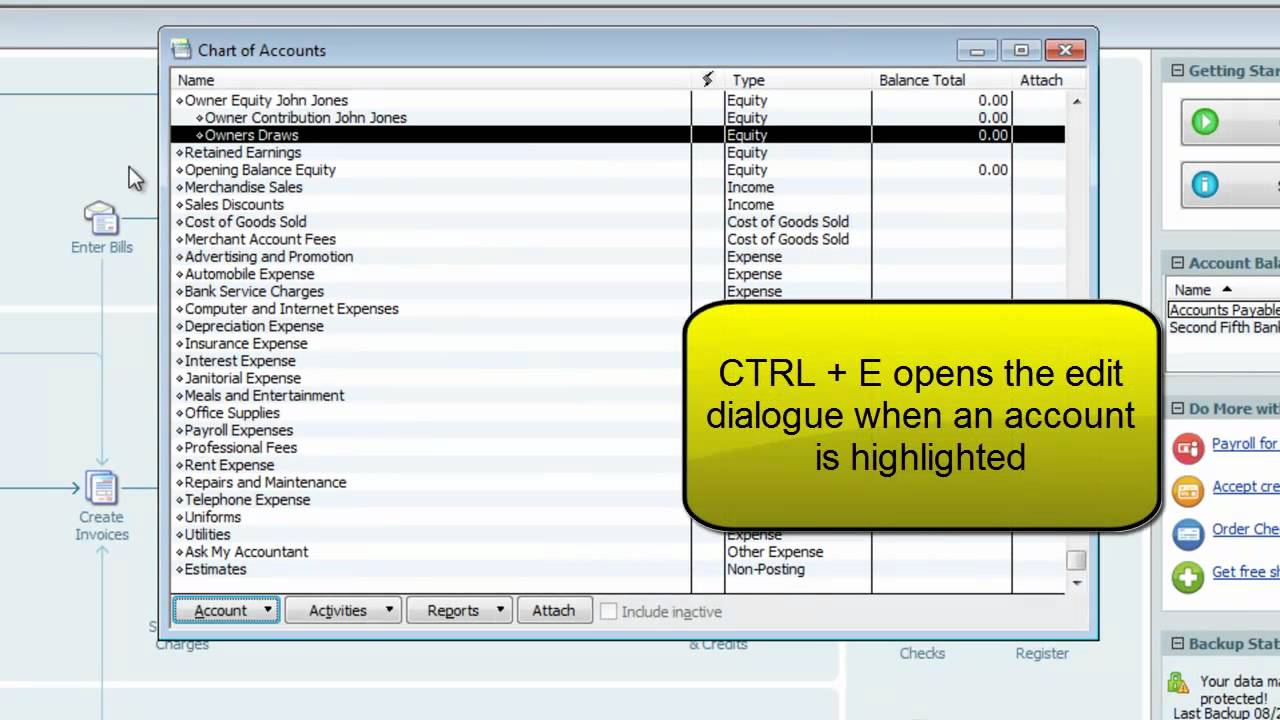

When I want to take money from the company I. An owner can take up to 100 of the owners equity as a draw. Open the chart of accounts and choose Add Add a new Equity account and title it Owners Draws If there is more than one owner make separate draw accounts for each owner and name them by owner eg.

The most common way to take an owners draw is by writing a check that transfers cash from your business account to your personal account. When income is earned by an s. Heres how to do it.

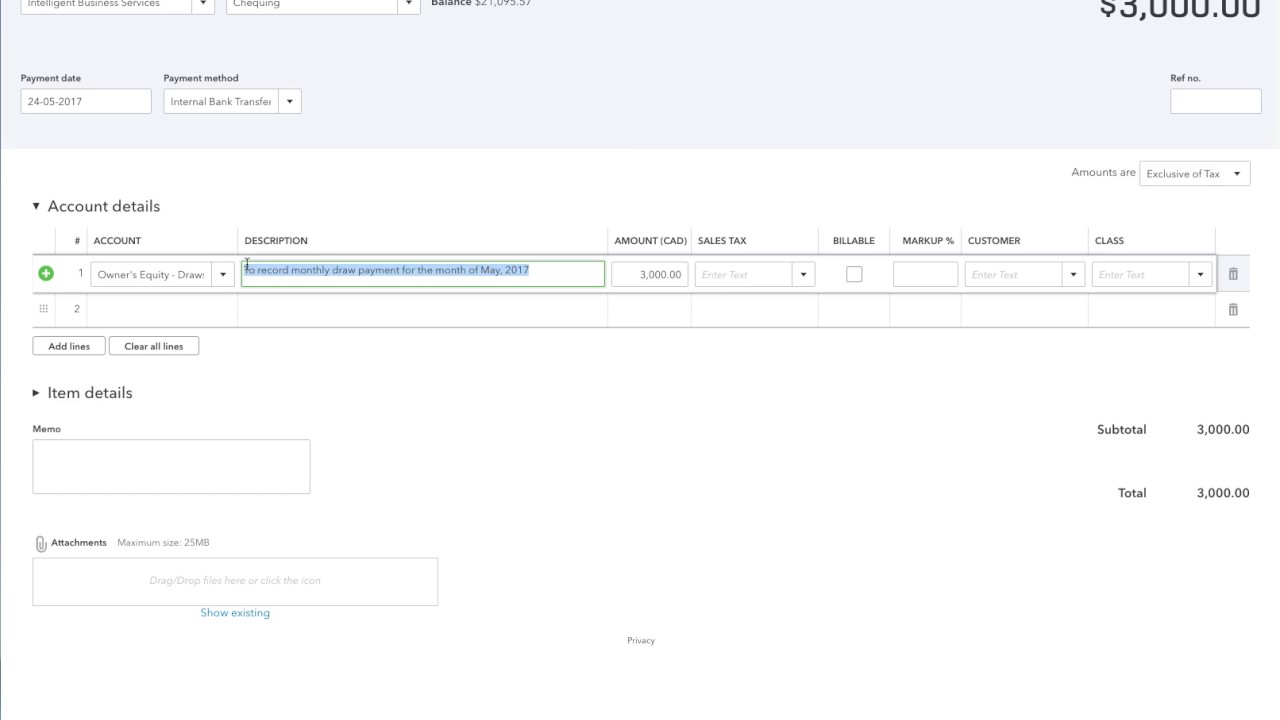

Set up and process an owners draw account Overview. The owners draw is the distribution of funds from your equity account. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Owners equity owners investment or owners draw. Under category select the owners equity account then enter the. Patty could withdraw profits generated by her business or take out funds that she previously contributed to her company.

From the PAY TO THE ORDER OF field select the vendors name. From the Account Type drop-down choose Equity. In the Chart of Accounts window select New.

An owner of a C corporation may not. Select Petty Cash or Owners Draw depending on the method you want to use to track funds. Quickbooks bookkeeping cashmanagementIn this tutorial I am demonstrating how to do an owners draw in QuickBooks------Please watch.

However the more an. An owners draw account is an equity account in which QuickBooks Desktop tracks withdrawals of the companys. Sole proprietors can take money directly out of their company as an owner draw and use the funds to.

Set up draw accounts. This tutorial will show you how to record an owners equity draw in QuickBooks OnlineIf you have any questions please feel free to ask. Click the Account field drop-down menu in the Expenses tab.

Instead shareholders can take both a salary and a dividend distribution. This leads to a reduction in your total share in the business. In this video we demonstrate how to set up equity accounts for a sole proprietorship in Quickbooks.

If youre the business owner and want to record an owners draw youll basically want to write the check out to yourself like you are paying yourself with a check. A draw lowers the owners equity in the business. Click the Expenses tab and then select the account category that best fits your needs.

First of all login to the QuickBooks account and go to Owners draw account. Record your owners draw by debiting your Owners Draw Account and crediting your Cash Account. A C corp dividend is taxable to the shareholder though and is not a tax deduction for the C corp.

Select the Gear icon at the top and then select Chart of Accounts. Now you need to choose the owner and enter an amount next to the currency sign. At the end of the year or period subtract your owners draw account balance from your owners equity account total.

Ive got an Owners Equity equity account set up and any time I Take money from my pocket and spend it on the company I log it in this account and categorize it properly for tracking purposes. Many small business owners compensate themselves using a draw rather than paying themselves a salary. In the window of write the cheques you need to go to the Pay to the order section as a next step.

To record owners draws you need to go to your Owners Equity Account on your balance sheet. If youre a sole proprietor you must be paid with an owners draw instead of employee paycheck. To record a transaction between the business and owners account go into the Banking menu in Quickbooks and select the option titled Write Checks.

An owner of a sole proprietorship partnership LLC or S corporation may take an owners draw. IRS guidelines on paying yourself from a corporation. Click on the Banking and you need to select Write Cheques.

So if you are a sole proprietor a partner or an LLC you can go for the owners draw. Enter the Amount. At the end of the year or period subtract your Owners Draw Account balance from your Owners Equity Account total.

S Corporations use Owners equity to show the. Owners draw in a C corp. Owners draws or withdrawals is never an expense.

Go to Banking Write Checks. The amount of the draw can be based on a set schedule eg once per month or it can be determined on an as-needed basis. Under account type select equity.

Quickbooks Online Tutorial Recording An Owner S Draw Intuit Training Youtube

How To Pay Invoices Using Owner S Draw

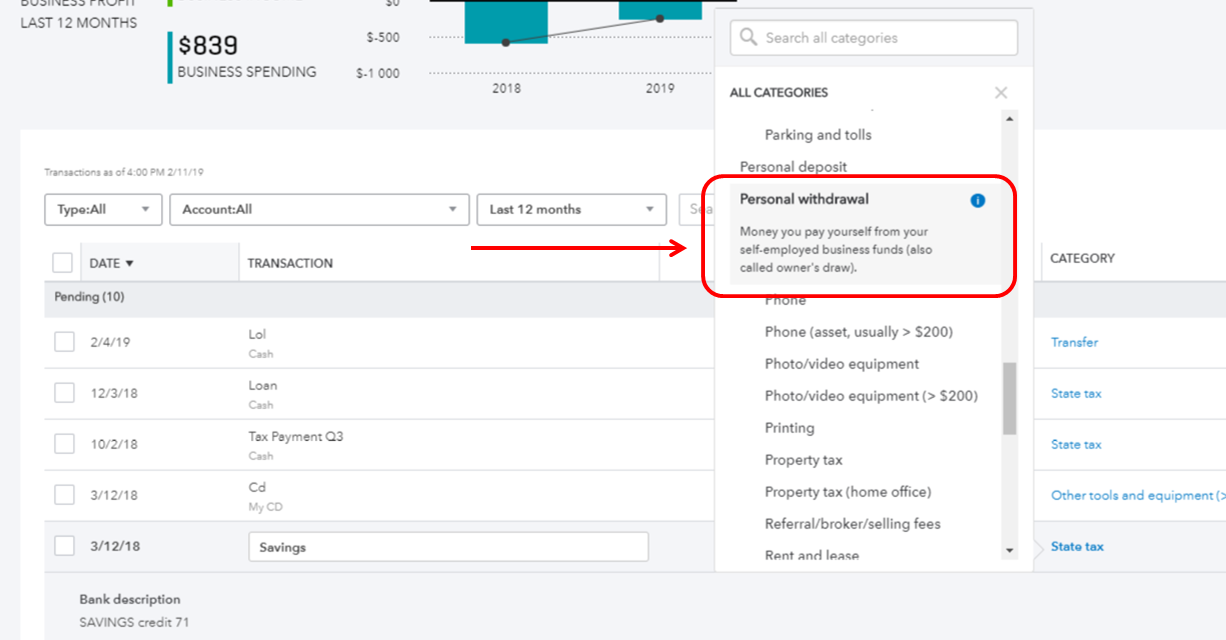

Solved Owner S Draw On Self Employed Qb

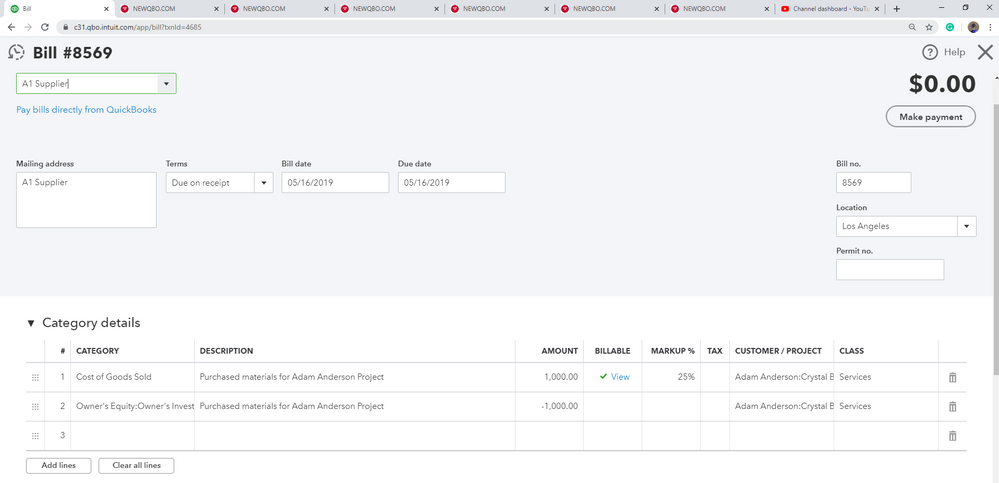

How Do I Make A J E With A Cr To Owner S Draw And Properly Record It In Cog Sold I Am Using Qbo Adv I Bought Items With My Personal Money That

Quickbooks Owner Draws Contributions Youtube

How To Record Owner S Equity Draws In Quickbooks Online Youtube